Important Changes to Your Accounts and Services

Location Access

All Union State Bank locations will be closed on Saturday, July 17th, 2020 for the system upgrade, and will resume normal business hours on Monday, July 20th, 2020.

Online Banking/Mobile Banking/Mobile Deposit

You will not have access to your accounts through Online or Mobile Banking beginning the evening of July 17th, 2020 until July 20th, 2020.

Bank Statements

As of the close of business on Friday, July 17th your current accounts will convert to the new computer system. You will receive a paper statement with account activity through July 17th, 2020. Fees or charges will not be assessed for this special statement. Your account will resume your normal statement cycle following completion of the system upgrade.

Statement History

Account history will not change. However, e-statements prior to January 1, 2020 will NOT transfer to the new system. As of July 17, 2020 you will no longer have access to e-statement history older than January 1, 2020. E-statements from January 1, 2020 to July 17, 2020 will be available to view through online banking later this year. We recommend you print or save any history prior to July 17, 2020 you may need.

Debit Card Service

For lost or stolen cards call 1-800-472-3272.

The customer service phone number printed on the back of debit cards issued prior to July 17, 2020 will NOT be valid as of that date. However, there will be no change to the functionality of the card itself. Once our upgrade is complete, you will have the option to enroll for CardValet™ through your Online Banking account to instantly manage, track and report specific types of usage and quickly detect unauthorized activity.

Quicken & Mint Users

As Union State Bank completes its system conversion, you will need to modify your Quicken settings to ensure the smooth transition of your data. Select your product from the list below for complete step-by-step instructions:

Quicken for Windows Web Connect

Following the upgrade, you will have access to new products and features such as Arch Checking, CardValet™, and Mobile Wallet. These new offerings will make your banking faster, safer, and more convenient.

Arch Checking

A FREE checking account that earns you interest with no minimum balance requirement, no monthly service charge, and no monthly reward qualifications!

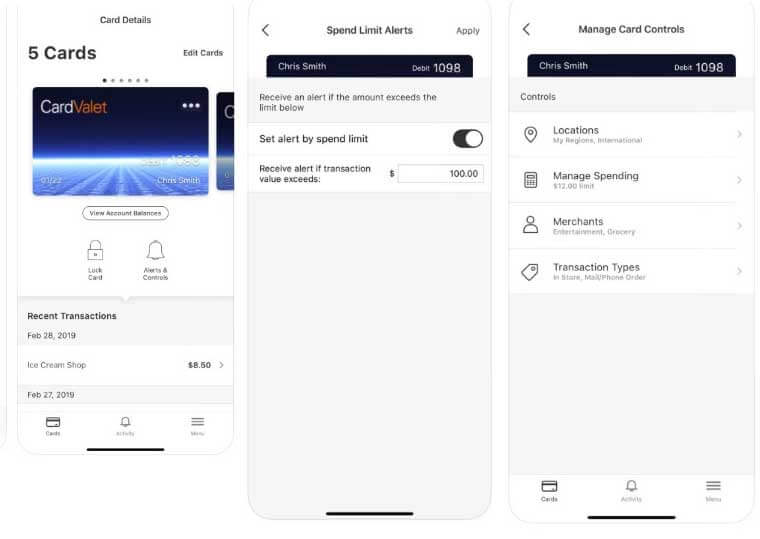

CardValet ™

Fight debit and credit card fraud with customized real-time alerts. Turn your cards on or off in an instant, for any reason. Control transactions by category or by dollar amounts. Easily set, customize and modify purchase alerts. CardValet™ is available in the Apple® and Android™ app stores and is quick to implement.

Mobile Wallet

Make secure payments using your Union State Bank debit card through your favorite Apple Pay, Google Pay, or Samsung Pay compatible device. (Coming Soon!)

Will my branch be open regular hours during the upgrade?

Do I need to order new checks or debit cards?

Why will I be receiving multiple statements?

Will I have to change my password for Online Banking after the upgrade?

Can I still qualify for my checking account rewards?

What about transfers and Bill Pay?

I need my statement history. What should I do?

We know you have a choice in banking, and appreciate having you as a USB customer! If you have any questions, our team is ready to help you. Visit your local branch or call us toll-free at (866) 557-0060.