Keep up with the latest news and happenings with Union State Bank!

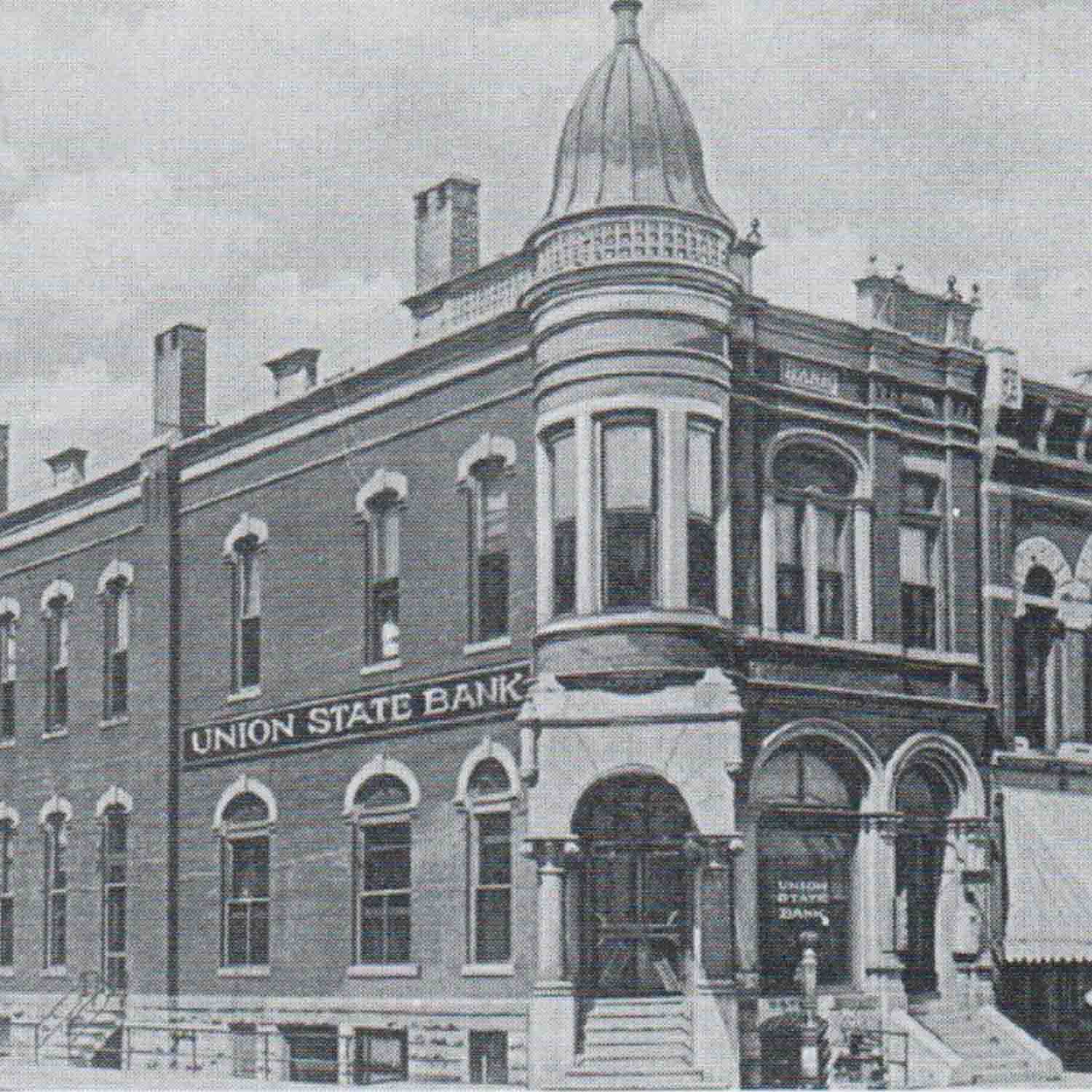

Bill Docking, Union State Bank Board of Directors Chairman Emeritus, wrote in a message to staff, “Along with almost everything else, community banking has changed over the last 115 years. However, the mission to which all of us at USB are committed endures.”

What does the end of penny production mean for day-to-day banking. While the shift represents a milestone in U.S. currency, staff from across Union State Bank emphasize that the transition will be gradual and for most people, barely noticeable.

The Cherokee Strip Landrush Museum celebrated the opening of the Docking Library exhibit on Sept. 18th, which contains family heirlooms representing the legacy the Docking family left upon government, education and the local community.

USB has seen a rise in check fraud, including counterfeit and altered checks. The bank is urging commercial customers to take advantage of their fraud prevention tools, such as their Positive Pay check verification service.

The year 2025 was defined by meaningful transitions, enhanced services, and a deep commitment to the communities Union State Bank serves.

Beginning January 1, 2026, Kansas law will require all public entities within the state to utilize a new method for securing deposits that exceed FDIC coverage.

With over 40 years of experience in the finance industry and mortgage lending, Nikkel will now assist USB customers with their home loan needs.

Marcene Carstensen, Mortgage Loan Officer in Newton, and Gary Watkins, Commercial Loan Officer in Wichita have concluded their careers.

Carr will partner with commercial clients to deliver tailored business solutions and strengthen Union State Bank’s treasury management capabilities across all markets.

For the 2026 campaign, 45 team members made financial pledges, while additional employees contributed by volunteering to support initiatives led by their local United Way chapters.