Flexible options. Conventional ease. HomeReady® is an affordable, low down payment mortgage product designed for low to moderate income borrowers.

HomeReady® Benefits

- Low down payment; as little as 3% down for home purchases.

- Flexible sources of funds with no minimum contribution from borrower’s own funds.

- Non-occupant borrowers permitted.

- Cancellable mortgage insurance (restrictions apply).

- Borrower is not required to be a first-time home buyer.

- Reduced mortgage insurance coverage requirement for loan-to-value ratios above 90% (up to 97%).

- Gifts, grants from lenders and cash-on-hand permitted as a source of funds for down payment and closing costs.

- Manufactured homes, condos and townhouses are eligible for financing.

HomeReady® Requirements

- The income limit for all HomeReady® loans is 80% of area median income (AMI) for the property’s location. Use the area media income lookup tool to see if you qualify.

- If all occupying borrowers are first-time homebuyers, then at least one borrower is required to take homeownership education.

- Minimum down payment of 3.00%.

- Minimum FICO credit score of 620.

- Other restrictions apply. Contact a Union State Bank mortgage lender for more information.

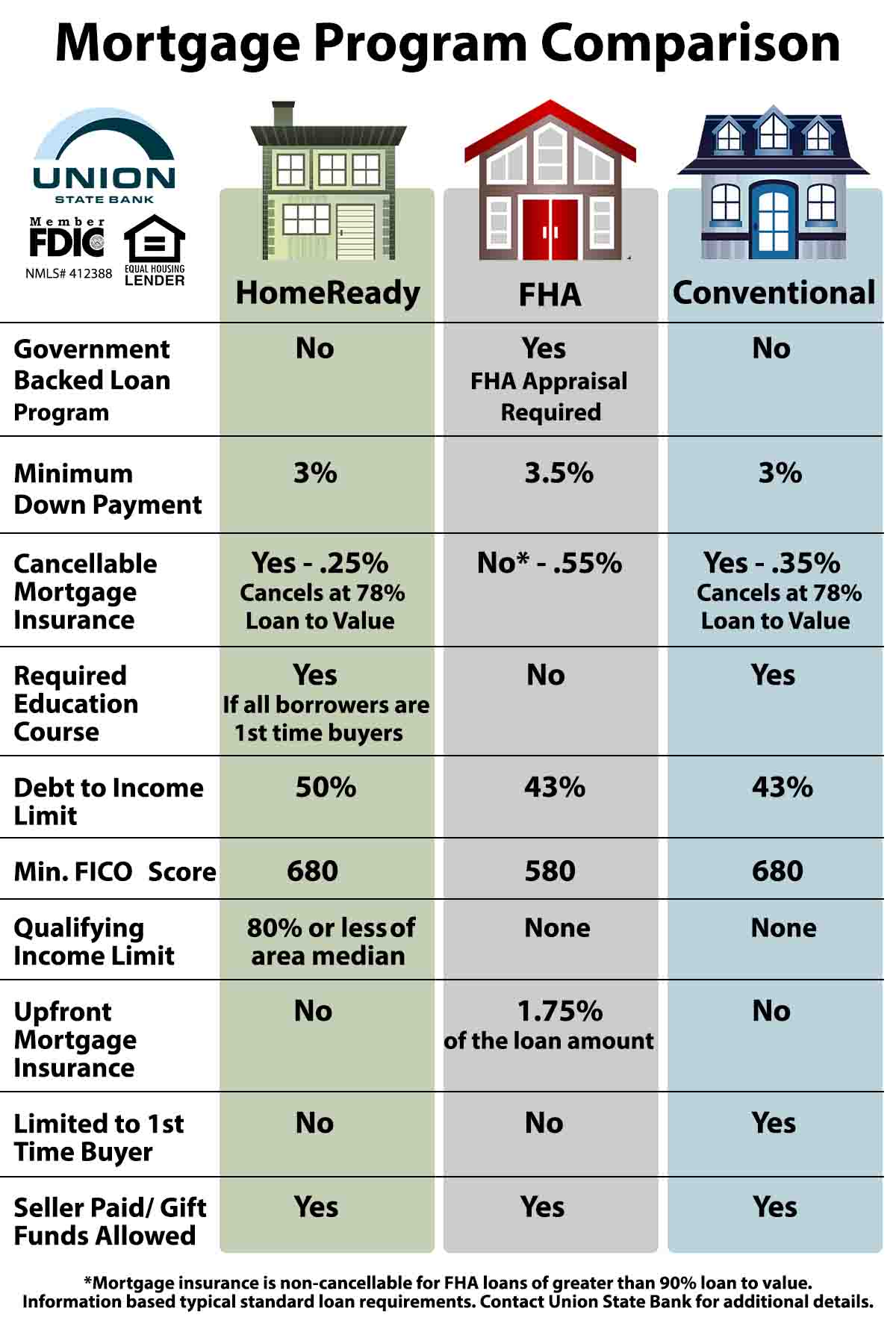

HomeReady® vs. FHA or Conventional Mortgage

First Time Home Buyer?

You do not have to be a first-time home buyer to qualify for a HomeReady® loan, but if you are you may also qualify for a Homeownership Set-aside Program (HSP) grant up to $7,500.00!

HSP grant funds may be used for down payment, closing cost and repair assistance to first-time homebuyers earning at or below 80% of the area median income for households purchasing or constructing homes in Colorado, Kansas, Nebraska and Oklahoma.