IntraFi Network Deposits (IND) is a smart, convenient way for bank customers to access multi-million-dollar FDIC protection on large deposits, earn a return, and enjoy flexibility.

What is IntraFi® Network Deposits?

Would you like to access multi-million-dollar FDIC protection on your deposits, earn interest, and enjoy flexibility at the same time? Now you can—through IntraFi Network Deposits.

With IntraFi Network Deposits (IND), you can:

- Rest assured. Make even large deposits eligible for protection that’s backed by the full faith and credit of the federal government.

- Earn interest. Put excess cash balances to work by placing funds into demand deposit accounts, money market deposit accounts, or both.

- Save time. Work directly with just our bank—a bank you know and trust. Receive just one monthly statement from us summarizing your account activity and balances. And, if you are accustomed to collateralization, reduce the need to track collateral on an ongoing basis.

- Access funds. Enjoy unlimited withdrawals of funds placed in demand deposit accounts, or make up to six program withdrawals per month of funds placed into money market deposit accounts. Your funds can be placed using either or both IND options to best match your cash management and liquidity needs.

How can deposits greater than the standard FDIC insurance maximum be eligible for insurance by the FDIC?

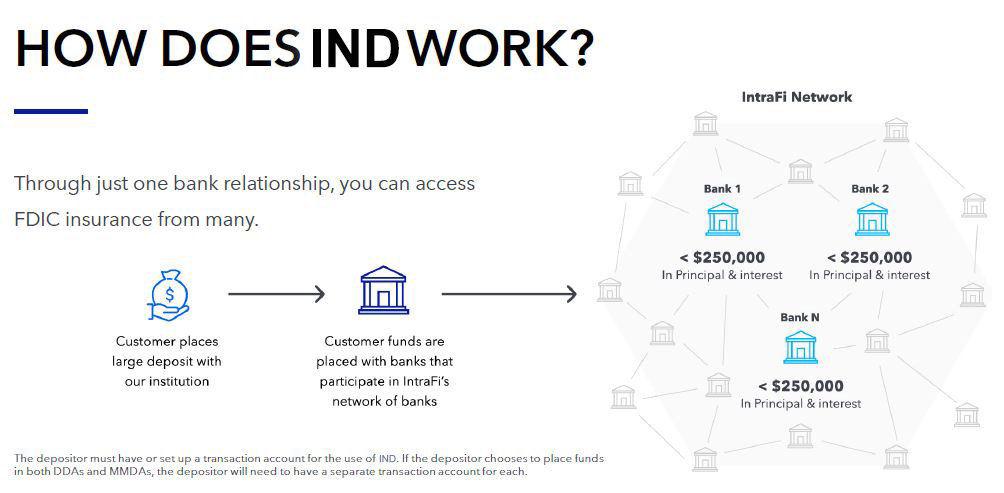

The FDIC insures up to $250,000 in a customer’s deposit accounts in a given insurable capacity at an FDIC-insured depository institution. When your funds are placed through IND, they are divided into amounts under the standard FDIC maximum and placed with other institutions participating in IntraFi's network—each an FDIC-insured institution. This makes your deposit eligible for FDIC insurance at each member bank.

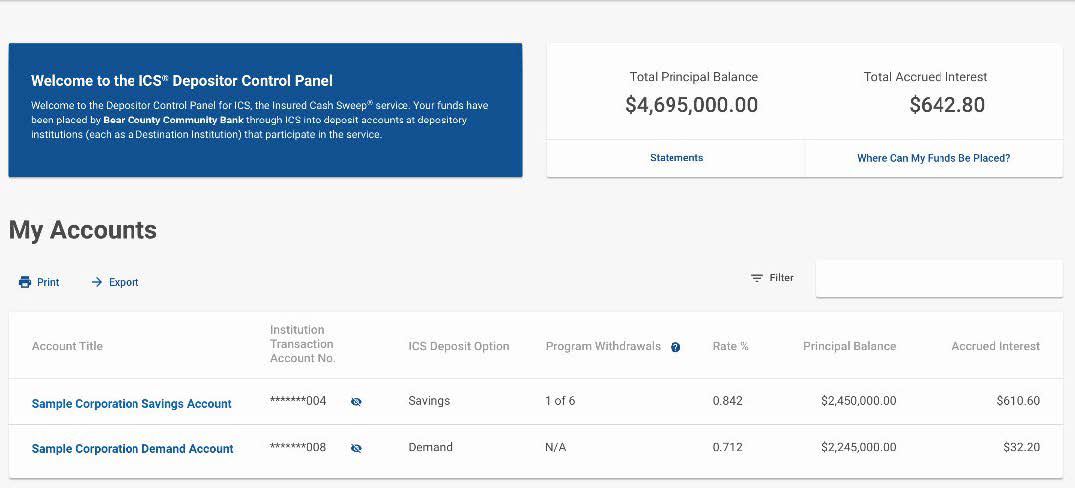

By working directly with our bank, you can access insurance through many. You do not pay a fee to use this service, and you receive just one consolidated, monthly account statement from us. (You can also see, online, where your funds are at all times.)

How often can I access my funds?

You can make unlimited program withdrawals of funds placed in demand deposit accounts and up to six program withdrawals per month of funds placed into money market deposit accounts.

Who has custody of my funds?

Funds placed through IND are deposited only in FDIC-insured institutions. We act as custodian for your IND deposits, and BNY Mellon acts as sub-custodian for the deposits.

Who provides the additional FDIC insurance when my funds are placed using IND?

Through IND, funds are placed with other institutions participating in IntraFi's network, and those Network members provide you with access to FDIC insurance coverage on deposits at those banks. Working directly with just our bank, you can access coverage through many.

Is my account information safe?

You work directly with just us—the bank you know and trust. As always, your confidential information remains protected.What is IntraFi Network Deposits CD Option?

IntraFi Network Deposits CD Option (IND-CDO), formerly known as CDARS, is one of the safest, smartest vehicles for investors looking to protect their large-dollar deposits while earning CD-level returns. CDs placed through IND-CDO offer:

- access to multi-million-dollar FDIC insurance;

- the ease of working through one trusted relationship, earning one rate per maturity, and receiving consolidated statements;

- relief from ongoing collateralization—because IND-CDO deposits are eligible for FDIC protection, you can eliminate ongoing collateral tracking;

- a finite maturity date (in contrast to auction-rate or some adjustable-rate securities); and

- the ability to have the amount of your deposit available to support lending initiatives that strengthen the local community.1

How can deposits greater than the standard FDIC insurance maximum ($250,000) be insured by the FDIC?

The standard FDIC insurance maximum is $250,000 per insured capacity, per bank. To protect a larger deposit, you could run around to multiple institutions to deposit your funds, or you could require a bank to collateralize your deposit and track changing collateral values on an ongoing basis.

Alternatively, you can have us place your large-dollar deposit using IND-CDO. Your deposit is divided into smaller amounts and placed with other institutions that use IND-CDO, each an FDIC-insured institution. Then, those member institutions issue CDs in amounts under $250,000, so that your deposit is eligible for FDIC insurance at each member bank. By working directly with us, you can access coverage from many institutions while receiving a single regular statement.

Who has custody of my funds?

Funds placed through IND-CDO are deposited only into FDIC-insured banks. We act as custodian for your IND-CDO deposits, and the sub-custodian for IND-CDO deposits is the Bank of New York Mellon (BNY Mellon).

Unique to IND-CDO, you as a depositor can obtain a confirmation of records maintained by BNY Mellon as sub-custodian to reconcile those records with the statements received from us. At any time, as often as desired, you as a depositor can obtain a certified statement from BNY Mellon that confirms the exact amount of your CDs, including principal balance and accrued interest, for each FDIC-insured institution that issues a CD through IND-CDO.

You can submit a request for the certified statement, along with BNY Mellon’s processing fee, through us. BNY Mellon will send the certified statement directly to you or to another party designated by you, such as an auditor.

How can my funds be used locally if my CDs are issued by financial institutions across the country?

When we exchange deposits with other institutions that use IND-CDO on a dollar-for-dollar basis, the same amount of funds placed through the network returns to us. As a result, the total amount of your original deposit can remain with our bank and be used for local lending. (IND-CDO Reciprocal transactions only.)1

Is my account information safe?

You work directly with just us—the bank you know and trust. As always, your confidential information remains protected.

What happens if a IND-CDO institution that holds my deposit fails?

Most of the banks that have failed in the United States in recent years did not use IND-CDO or did not hold any IND-CDO deposits when they failed. When a IND-CDO institution has failed, the bank’s CDs issued using IND-CDO in most cases have been transferred to a healthy institution—the FDIC’s preferred method for handling bank failures. In cases where the FDIC has been unable to find a healthy institution willing to accept such a transfer, it has arranged for the payment of the insured principal and accrued interest to the depositors. This payment has usually occurred within a matter of days.

Deposit placement through IntraFi Network Deposits is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits.

A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi and IntraFi Network Deposits are registered service marks, and the IntraFi hexagon and IntraFi logo are service marks, of IntraFi Network LLC.

Contact Us For More Treasury Information

Contact Us

Or call the Treasury Department at 620-741-3069.